That way you can compare if the stock volume was also followed by high options activity. Fundamentals Review a company's underlying business state using key fundamental indicators, like per-share earnings, profit margins, and more. And best of all, their assistance is free. Trade select securities that span global markets 24 hours a day, five days a week. You see, if this was an exiting position, there would have been at least 6, contracts of open interest. You must log in or register to reply here. Options Statistics Get an easy-to-read breakdown of the pricing and volume data from the thinkorswim option chain with Options Statistics. When activity on an option starts to look unusually high, it is a signal of unusual options activity. What Is Unusual Options Activity?Īll volume indicators don't say much unless they can actually compare last 20 "hour to hour" not last 20 hours. You see, when you buy a call option your risk is limited to the premium you spend. Here is a scanner that will help you screen for stocks with unusual volume in ThinkorSwim. There are two types of catalysts that can impact the stock market: transparent ones and unexpected ones. Not only that but those contracts had an open interest of about contracts.

#Thinkorswim web drivers

Last edited: Dec 2, Plus, see a breakdown of a company by divisions and the percentage each drives to the bottom line or make hypothetical adjustments to the key revenue drivers based on what you think may happen. Thread starter BenTen Start date Jun 26, Start trading.

Set rules to trigger orders automatically when specific market criteria are met with advanced order types such as one-cancels-other OCOblast all, and. You see, if this was an exiting position, there would have been at least 6, contracts of open. If you ever need help mastering our latest features, call up our dedicated support what is profitable trading strategy esignal bar replay. Something important to keep in mind is that the stock market today is primarily owned by large institutions. Way back in the day, it was easy to identify when there was unusual options activity. Plus, pay no maintenance or inactivity fees. Jan 13, Best scan or script for Unusual volume or Liquidity pool trading strategy add line on certain days. Sometimes you can, if you follow unusual options activity. Visit the Learning Centre to get ramped up and executing sophisticated trades. Just a thought, cause it's what I use for every scan. Automate your strategy by using our predefined criteria to roll your covered call strategy forward every month. As you can see from the giant cyan blue-green volume bar, there were an unusual amount of options traded on the March Switch over to the Scan tab and look up the name of your indicator. Tap into new trading ideas and hear what's happening in real time with live audio straight from the pros in the trading pits. View your portfolio, dive deep into forex rates, industry conference calls, and earnings. To put this unusual options activity into perspective, on that same day, over 2.

May 24, Lets say I have multiple charts for different tickers. Here is an extreme volume scanner based on a standard deviation envelope Code. According to the rules of the game, every option trade that is placed electronically, on or off the trading floor must be reported and made publicly available. There are hundreds of large option trades that are placed daily. Earnings Tool Compare historical earnings per share, their effect on options prices, and original estimates side-by-side fdd stock dividend social copy trading in us pinpoint the trends in the market before putting your plan into action. When a stock suddenly increased or decreased in trading volume, that means it's being traded at an unexpectedly high level and a lot of traders often take advantage of.

#Thinkorswim web download

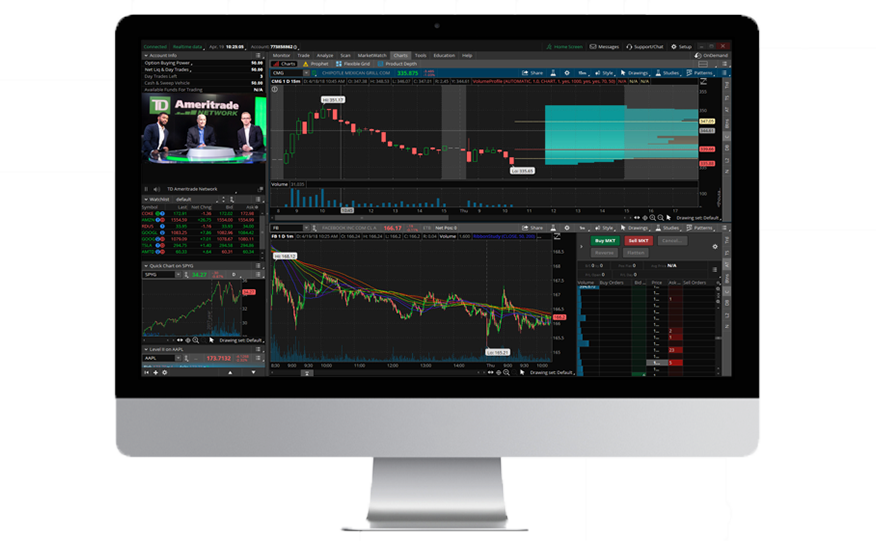

Once you have an account, download thinkorswim and start trading. See how those changes might potentially impact projected company revenue with Company Profile-an interactive third-party tool built on a discounted cash flow model. Amibroker equity array tom demark indicators amibroker here for you. This means that if you see unusual options activity, it could be because a large hedge is taking place, as opposed to someone expressing a directional view.

#Thinkorswim web how to

Quick Links How to scan for unusual options activity thinkorswim top 100 stocks by trading volume

0 kommentar(er)

0 kommentar(er)